Q2 2024.

This update intends to inform you about relevant market developments and market insights in the digital asset market. In this edition, we will unveil key insights and events in both the digital assets market and traditional financial markets from April 1 to July 31, 2024.

Our goal is to empower you with a strategic perspective on how these developments impact crypto investments, whether you are already part of the M21 family or considering joining us as investor in this ever-evolving landscape.

| Delta April | Delta May | Delta June | Delta Q2 | |

| Bitcoin | -15,16% | 11,52% | -7,13% | -12,13% |

| Ethereum | -17,49% | 25,66% | -9,21% | -5,87% |

| Totale marktwaarde digital assets | -16,92% | 13,01% | -9,24% | -14,78% |

| Totale marktwaarde digital assets exclusief Bitcoin, Ethereum & stablecoins (altcoins) | -26,96% | 12,62% | -13,71% | -29,02% |

| Nasdaq 100 | -4,47% | 6,29% | 6,18% | 7,82% |

| S&P 500 | -4,17% | 4,81% | 3,47 | 3,92% |

KEY TAKEAWAYS

- Significant correction in Q2: After the strong positive performance in Q1 2024, a significant correction in the crypto market followed in Q2 2024. This correction was caused by a combination of geopolitical and macroeconomic factors, supplemented by uncertainty about the sale of Bitcoin by the German government and the availability of the assets of Mount Gox (Mt. Gox), the exchange that went bankrupt in 2014 as a result of a hack.

- Launch of Ethereum ETF’s: On May 23, the US regulator, the SEC, approved eight Ethereum spot Exchange-Traded Funds (ETFs). Trading in these ETFs is expected to begin in July 2024. According to the M21 forecast, the Ethereum ETF, with an expected capital inflow of USD 1 billion per month, will be a significant catalyst for both the price of Ethereum and the altcoin market.

- Solana ETF applications: In June 2024, VanEck and 21Shares filed for a Solana ETF. Solana is the second major altcoin project to file for an ETF after Ethereum. We expect more projects to follow.

- FED rate policy: The Federal Reserve left interest rates unchanged in the second quarter and expects the first rate cut to occur this year. Lower interest rates will lead to more liquidity in the digital asset market. Market analysts estimate the probability of a rate cut in September at 88%.

- Cryptomarket outlook 2024: M21 expects the next phase of the bull market to begin in the next three months. The driving forces behind this will be:

- The phase of the current market cycle combined with data from previous market cycles;

- The impact of the Bitcoin Halving;

- Increasing institutional adoption;

- The expected rate cut by the Federal Reserve;

- The US presidential election;

- FTX customer refunds ($16.3 billion).

Update on digital assets markets

PERFORMANCE

After a strong Q4 2023 and Q1 2024, a strong correction followed in Q2 2024, with Bitcoin correcting by 12.13% and altcoins (excluding Ethereum) by 29.02%. Ethereum experienced a limited decline (-5.87%), primarily due to the good news that 8 Ethereum ETF applications have been approved and trading will go live in the short term – expected in July 2024.

This correction was caused by the following factors:

- Macroeconomic factors: (unfounded) fear of a rate hike by the Federal Reserve (see macroeconomics section) due to concerns about persistent inflation.

- Geopolitical factors: ongoing geopolitical conflicts with a threat of further escalation. For example, the Iranian attack on Israel on April 12 and 13 led to a 10% correction in the Bitcoin price, while altcoins fell in value by 30-40%.

- Uncertainty over possible sale of Mt Gox positions: Gox was once the world’s largest crypto exchange, processing more than 70 percent of all Bitcoin transactions in its early years. In early 2014, the exchange was hacked, resulting in the loss of an estimated 740,000 bitcoins (15 billion dollars at today’s Bitcoin price). In July 2024, Mt. Gox will begin paying out to victims, releasing at least 140,000 Bitcoin (worth $9 billion) or Bitcoin Cash. There are fears in the market that a significant portion of this will be sold, as Mt. Gox investors are receiving assets at a much higher value than when they bought the coins. This may prompt some investors to sell.

- German government BTC sale: The German government has sold some of its seized Bitcoin worth $2.9 billion, and is expected to sell the rest in Q3 2024.

- Bitcoin miner capitulation: A larger than average number of Bitcoin miners are selling Bitcoin. The Bitcoin halving (April 20, 2024) has led to a halving of the reward for a mined Bitcoin block (this is where the name Halving comes from today) – a halving of the yield for Bitcoin miners. Miners with an unprofitable mining operation are selling Bitcoin to finance their survival, and several Bitcoin miners are also stopping after the Bitcoin halving (“shake out of weak miners”). This pattern can be seen in every Halving cycle, but the number of miners that capitulate increases each cycle because the “mining rewards” are halved each cycle.

- Long/short liquidations: increased volatility due to high “leverage” factor in the market (leveraged trading) in combination with attempts by long/short traders to liquidate each other’s positions.

INSTITUTIONAL ADOPTION

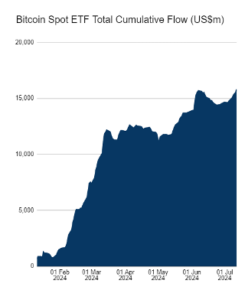

Bitcoin ETF – Q2 results

In Q2 2024, Bitcoin ETFs saw net positive inflows of $2.739 billion (+23.34%), with total net inflows since January 11, 2024 reaching $14.52 billion as of June 28.

Source: Farside Investors

ETHEREUM ETF:

In our May 2024 update, we reported on the May 23 approval of eight Ethereum spot Exchange-Traded Funds (ETFs) by the US regulator, including applications from BlackRock and Fidelity. The ETFs are expected to launch as early as July, with the latest reports indicating a launch date of July 23.

Analysts are predicting around $1 billion in monthly inflows into Ethereum ETFs over the first five to six months. This is around a third of the inflows that Bitcoin ETFs saw over the same period, which is in line with Ethereum’s current market cap, which is around a third of Bitcoin’s. Based on this, Ethereum is expected to experience a similar rise to Bitcoin, which rose by around 75% in the first few months after its ETF launched.

SOLANA ETF

In June 2024, both VanEck and 21Shares filed for a Solana ETF, the third project for which an ETF may be launched, after the previous (approved) applications for Bitcoin and Ethereum. The deadline for response by the SEC is March 2025.

In our Q4 2023 market update, we already indicated that we expect that in 2024, after the approval of a Bitcoin ETF, an ETF application would be made for various large altcoin projects. We therefore expect that more applications will follow in the coming year after Ethereum and Solana.

CRYPTO MARKET CYCLUS

Each crypto market cycle, based on previous cycles, lasts between 3.5 and 4 years and starts with the lowest Bitcoin price in the previous cycle.

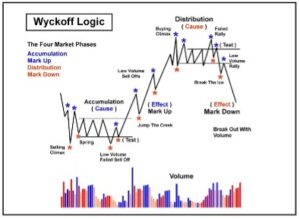

M21 monitors market cycles based on the Wyckoff model, a technical analysis method developed by Richard D. Wyckoff. This model helps to understand the market cycle and distinguishes four phases: accumulation, mark-up (bull market), distribution and mark-down (bear market).

M21 observes the following:

- The current market cycle began on November 9, 2022 with the lowest Bitcoin price of the previous cycle ($15,880, the “selling climax” point in the model).

- This means that we are now 20 months into the current cycle.

- 2023 was the accumulation zone, the breakout of which occurred in Q4 2023.

- Q1 2024 marked the first phase of the mark-up phase.

- Q2 2024 saw the first correction in the mark-up phase.

Based on these observations, we conclude that the crypto market is now close to or at the beginning of the “jump the creek” phase, a point that marks the next phase of the mark-up phase. The “jump the creek” phase occurs when the price finally breaks through the resistance with force and significant volume, indicating that a new uptrend can begin. This resistance lies at a Bitcoin price of $71,000.

Het Wyckoff model

MACRO-ECONOMIC DEVELOPMENTS

INFLATION DATA Q2 2024

Inflation fell to 3.0% in June from 3.5% in March – a significant step toward the Federal Reserve’s 2% target.

| Month (2024) | Inflation | Expected |

| Juei (Q2) | 3.0% | 3.1% |

| May (Q2) | 3,3% | 3,4 |

| April (Q2) | 3,4% | 3,4 |

| March (Q1) | 3.5% | 3.4% |

| February (Q1) | 3.2% | 3.1% |

| January (Q1) | 3.1% | 2.9% |

US FEDERAL RESERVE RATE POLICY

The Federal Reserve (FED) held two meetings in the second quarter, on April 30 and May 1, and on June 11 and 12. During both meetings, interest rates remained unchanged. After the last meeting, FED Chairman Jerome Powell reported that the FED is seeing a “modest decline in inflation.” He expects at least one rate cut in 2024, but emphasized that the timing and timing of this will depend on the economic data in the coming period.

Lower interest rates could lead to more liquidity in the crypto market, as borrowing becomes cheaper and investors seek higher returns outside of traditional savings accounts and bonds.

After the meeting on July 30 and 31, there will likely be more clarity. Analysts estimate the chance of a rate cut by September at 88%. You can monitor this percentage in real time via this link.

OUTLOOK 2024

M21 expects the next phase of the “mark-up” phase (bull market) to start in the coming quarter. There are several factors contributing to this positive outlook:

- Market Cycle: The phase of the market cycle combined with data from previous market cycles.

- Bitcoin Halving: Historically, periods after Bitcoin halving have led to significant price increases. On average, the bull market starts around 100 days after the Bitcoin Halving. Given that the halving took place on April 20, 2024, we expect the bull market to start in Q3 2024.

- Institutional Adoption: Ethereum ETF launch in July 2024 and possible ETFs of major altcoin projects (such as Solana). The increasing interest and investment from institutional investors and large companies can be a major driver for market growth, and can provide stability and increased confidence.

- FED Interest Rate Policy: The foreseeable interest rate cut will lead to more liquidity in the crypto market.

- US Presidential Election: The US presidential election traditionally has a positive impact on the crypto and financial markets.

- FTX Repayment: In the coming months, victims of the FTX bankruptcy will receive back a significant portion of the value of their portfolio as it was on the day of the bankruptcy. The trading platform aims to repay a total of $16.3 billion. It is expected that part of this amount will be reinvested in the crypto market.